Today I’m going to teach you how to stop overthinking when creating content and help you create a client avatar (not the blue ones from the film) so you know EXACTLY who you’re creating content for.

By creating content that’s laser focused at your ideal client, it’ll reduce the time sat there thinking “What do I post?” 🤔 and instead get you thinking “That would go down well with my audience” 😎

Over time you’ll build trust with your audience and become the go to adviser, when it comes to sorting their mortgage.

Most people fail because they think they’re missing out by creating content that will only resonate with one particular section of their audience, so they revert back to ‘generic’ content: we’re going to change that today! 😍

Creating content for everyone is a sure fire way to fail

How to create your Client Avatar: ⤵️

First thing we’re going to do is shut down the laptop, turn your phone off and go old school! 📝

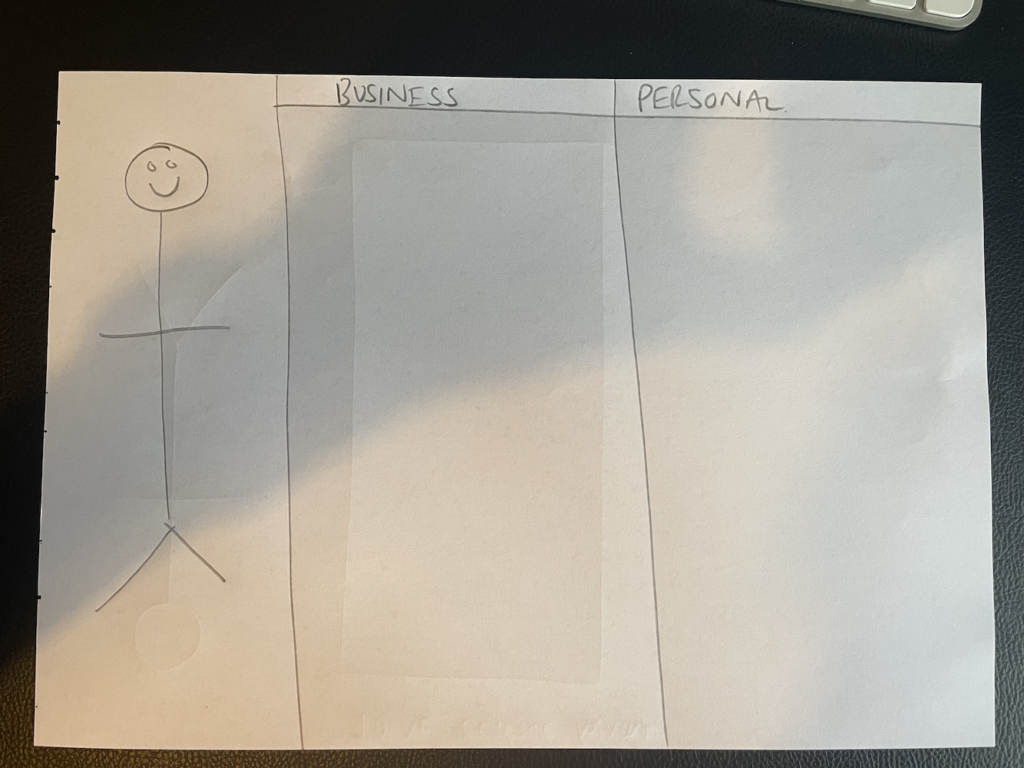

Yep that’s right, grab a piece of paper out the printer and a pencil, and draw a stick man or woman on the left hand side of the page (it can be as simple or as elaborate as you want)

Then draw a line down the middle to the right, label one side “Business” and one “Personal” just like this:

We’re going to pretend that this person is your one of you clients, someone that you come across several times every month.

With that in mind we’re going to fill out each section with the following:

💼 Business Section:

This section is any information that surrounds anything to do with their mortgage:

- Average Age

- Average Income

- Occupation

- Location

- Average Budget

- Position (FTB, Homeowner, Landlord)

- Average Deposit amount

💙 Personal Section:

When you’ve done that one, we’re then going to fill out the personal section with anything that’s going on in this fictitious character’s life:

- Where do they holiday?

- How many children do they have?

- Do they have any pets?

- What do they watch on Netflix?

- Which supermarket do they shop at?

- Are they an office worker or work weekends?

- What hobbies do they have?

When you’ve done this you should have a page brimming with facts about this person and created a client avatar.

Now give this person a name.

You should now have an idea of who you client avatar is, an example could be:

Jane:

A 30-40 year old married mum who has 2 children, works in a local office with average income of £40,000, spends most of her life organising the kids after school clubs!

Jane is a home owner and been through the mortgage process a few times now.

Holidays in Europe with her family and loves to take campervan holidays in the UK when she can.

Hobbies include playing hockey at her local club, searching Instagram for interior design accounts that give her inspiration and taking her dog out for walks.

So now instead of creating mortgage content for everyone, create your content specifically for Jane.

Look how different your content can now be:

Before:

A social media post about how we can do all the searching for you when it comes to a mortgage

After:

“We know as busy professionals your mortgage is the last thing on your mind!

You look after the kid’s clubs, we’ll sort the mortgage!”

Let’s do another one:

Before:

A social media post about how income protection can help you pay the bills if you couldn’t work due to injury or illness.

After:

“What would happen if your hobby stopped you from working?!

We love our hobbies, but could they stop you paying your mortgage?

Speak to us about how income protection could include fracture cover”

Can you see the difference in these two examples? 🤩One is scatter-gunning anyone and everyone. The other is creating content that will resonate with Jane (and probably a lot more people that fall into those categories.)

You don’t have to stop there, you can make several client avatars, but make sure they’re in detail and uses them to create content that resonates.

By creating content for your audience, you’ll build that trust as they will feel like you’re speaking directly to them.

That trust over time will be the difference between them choosing you (someone they trust and can resonate with) and choosing another mortgage adviser who they don’t feel is on their level. 🤝

Give it a go and let me know how you get on Instagram